In practice, job-order costing is used by companies that produce unique, custom-made products or services. By accurately calculating the cost of each job or order, companies can determine the selling price of the product or service and make informed business decisions. An allocation base or cost driver limited liability company llc is a production activity that drives costs such as direct labor hours, machine hours, direct labor dollars, or direct material dollars. When a job is finished, the total costs for the job are moved from the Work In Process inventory account (credit) to the Finished Goods inventory account (debit).

Optimizing your operations based on job data

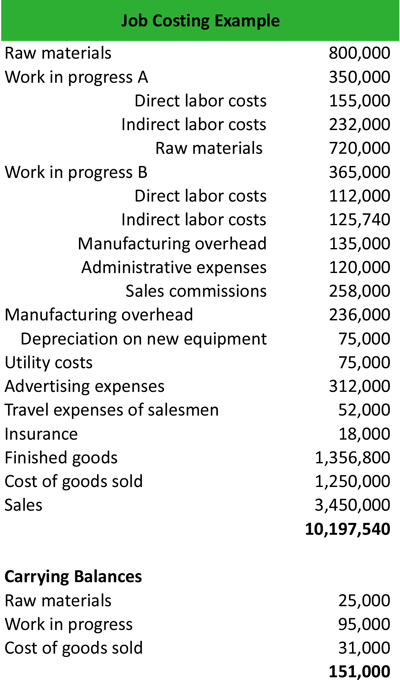

This sheet will help you evaluate if the actual cost of doing the job differs from your estimate. If they differ a lot, it means that either your estimation process or your manufacturing process can be improved. This can be due to incorrect estimation or inefficient implementation of the job. Since every cost incurred in this job can be tracked, it is easy to find out where the mistake or excessive consumption has occurred so that it can be rectified. Overall, job-order costing is a critical tool for manufacturing companies to determine the production cost for each job or order accurately.

To make data-driven decisions

One of manufacturing companies’ most common job-order costing mistakes is misallocating overhead costs. Overhead costs are indirect costs that are not directly related to the production of a specific product or service. These costs include rent, utilities, depreciation, and other administrative expenses. If these costs are correctly allocated to the specific job or order, it can lead to the accurate cost of production and pricing decisions. Job-order costing is suitable for manufacturing companies that produce products in varying production runs. Each production run requires different materials, labor, and overhead expenses.

Fulfill orders more efficiently. Try Zoho Inventory Today!

Combining scientific literature with his easily digestible writing style, he shares his industry-findings by creating educational articles for manufacturing novices and experts alike. Collaborating with manufacturers to write process improvement case studies, Madis keeps himself up to date with all the latest developments and challenges that the industry faces in their everyday operations. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- While some overhead costs are fixed (like rent) others are variable (like shipping) or semi-variable (utilities).

- The equivalent unit is determined separately for direct materials and for conversion costs as part of the computation of the per-unit cost for both material and conversion costs.

- Here, the estimated cost allocation base could be the estimated machine hours or labor hours.

- Job order costing requires that the cost of each aspect of production is recorded separately.

The overhead costs per activity are then added together to arrive at the total overhead for the job order. Direct labor is the cost of the employees who are directly involved in the product’s production process. It includes their wages and any other benefits they are offered while working on the product. For example, the person who collects wood pulp and sends it for processing into paper, and the person who monitors the whole production process from start to finish are both considered direct labor. Whereas the guards or the janitors who are employed to supervise and assist during the production process are indirect laborers and are not included as a part of direct labor.

Job-order costing can be a time-consuming process that requires a significant amount of administrative work. This can be particularly challenging for small manufacturing companies that may need more resources for this process. For example, a small business manufacturer may consider any job valued over $1,000 as a single job, but they may group smaller customer orders together in blocks of $1,000 for costing purposes. Rookwood Pottery makes a variety of pottery products that it sells to retailers. With processing, it is difficult to establish how much of each material, and exactly how much time is in each unit of finished product.

Accounting is also responsible for ensuring that the cost data is properly allocated to the appropriate financial accounts, such as inventory, cost of goods sold, and accounts payable. This information is used to prepare financial statements that accurately reflect the cost of production and the company’s profitability. Job-order costing can be inflexible, particularly for manufacturing companies producing large product volumes.

Accounting is critical in job-order costing, as it tracks and reports on the cost data for each job or batch. The accounting function is responsible for setting up the cost accounting system, including defining the cost pools and allocation methods and ensuring accurate cost data is collected and recorded. Medical services businesses, including hospitals, small doctor’s offices and medical billing companies, can use job order costing to consider each patient or bill as an individual job.

Recent Comments